All About M&a Crm: Best M&a Crm Software

Wiki Article

M&a Crm: Best M&a Crm Software Things To Know Before You Get This

Table of ContentsThe Single Strategy To Use For M&a Crm: Best M&a Crm SoftwareM&a Crm: Best M&a Crm Software - QuestionsAbout M&a Crm: Best M&a Crm SoftwareSome Known Incorrect Statements About M&a Crm: Best M&a Crm Software The M&a Crm: Best M&a Crm Software Ideas

Some of the largest company mergers in background can highlight the scope of these deals and what business stand to benefit from going via the procedure. When mergers reach this range, federal governments get included, as the splashing impacts of the merging can drink up whole economic situations. This merging put two powerhouses with each other, as well as the new firm developed the roadmap for making use of wire framework to swiftly and significantly enhance web gain access to and also performance.Initially, Warner-Lambert was planning to offer to a various firm, American Home Products. That offer fell down, and Pfizer swooped in to finish a merger of its own. The merger experienced for $90 billion, and also the two firms had the ability to combine profits for production and also distribution of the cholesterol medication recognized as Lipitor.

M&a Crm: Best M&a Crm Software Can Be Fun For Everyone

These were already 2 of the largest oil refinery and distribution companies in the world. Their merger consolidated those resources, as well as the effect was so fantastic that it altered the rate of crude oil permanently. The Disney and also Fox merger was announced in 2019 to the song of $52.

On January 4, 2022, Oracle introduced that it has become part of an arrangement to obtain Verenia's Net, Suite CPQ company. This purchase will bring Net, Suite customers indigenous configure, rate and also quote (CPQ) functionality to allow quick as well as precise assisted selling. Verenia's non-Net, Suite CPQ and CRM item lines as well as clients are maintained by Verenia LLC.

An Unbiased View of M&a Crm: Best M&a Crm Software

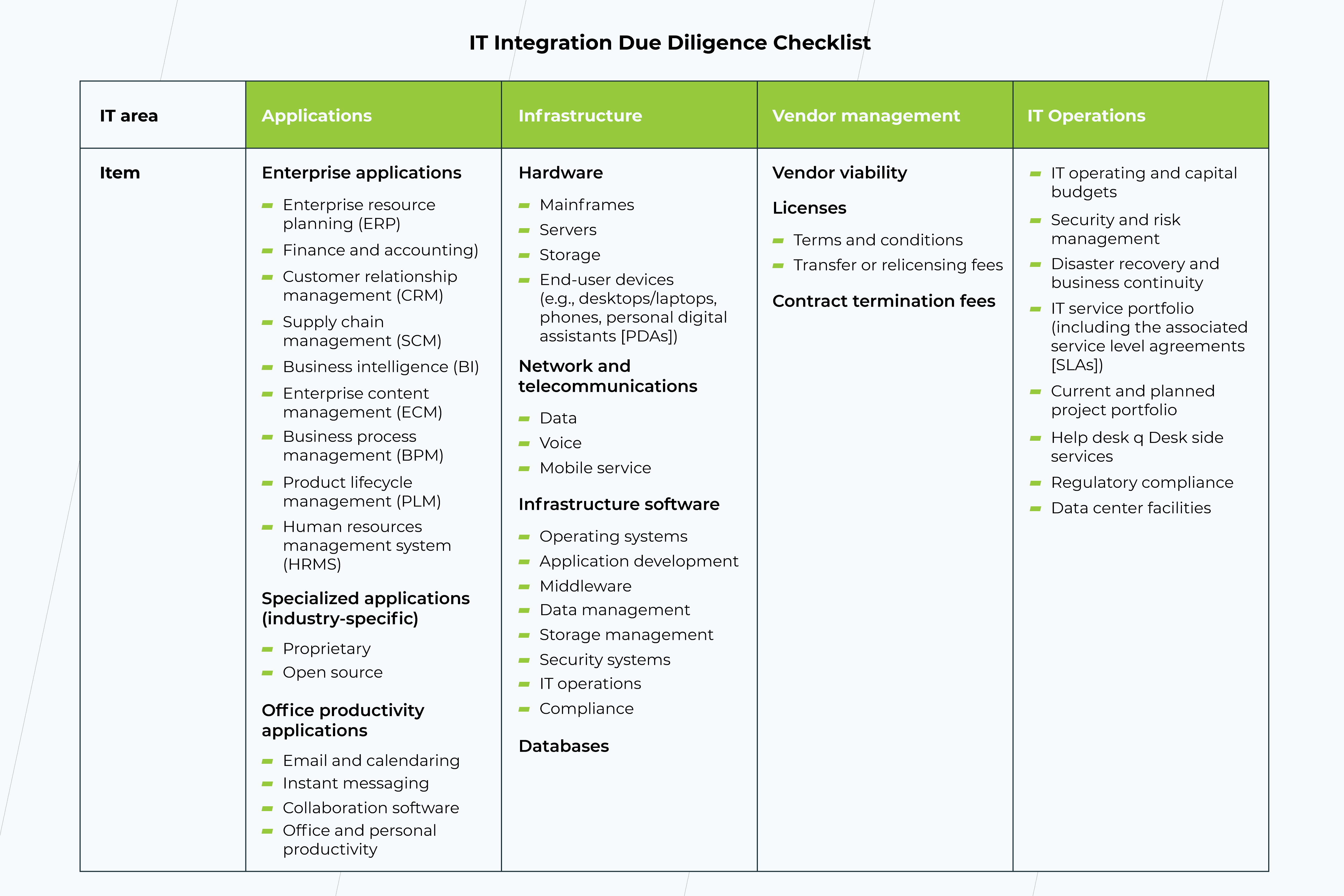

Details Technology (IT) is no much longer an expense center or division for many modern companies; it is the very core of a company's method. In lots of cases, it merely is the method. In a previous write-up, we looked at how IT is a vital to recognizing the possible value motorists in mergings and also acquisitions (M&A).70-90 percent of mergings fail to bring the worth anticipated1. Fifty percent of the synergies offered in a merging are strongly related to IT3.

M&a Crm: Best M&a Crm Software Things To Know Before You Get This

Guarantee you understand the structure and also area of the data that will require to be transitioned. Appointing data proprietors by place and data type (customer, distributor etc.) can typically assist to make certain that nothing is missed out on. Guarantee you have testing techniques as well as criteria agreed as you start the change to guarantee a top quality result.is altering the characteristics of M&A transactions. IT made use of to represent a price that required to be handled as well as controlled as two organizations collaborated. Today, IT as well as digital capacities are frequently the driving force behind the deal. However, also when a click to read more purchase centers around a firm's various other attractive assets, electronic capacities can offer a significant resource of extra deal value, especially for heritage firms still having a hard time to reach electronic citizens and the even more technologically advanced and entrenched gamers in their corresponding markets.

Together with innovation value, acquirers need to likewise recognize the possible innovation dangers as they conduct their due diligence. Some companies lug threat in the type of large IT jobs that have actually capital funding committed for years right into the future (M&A CRM: best M&A CRM Software). Not just must a potential acquirer examine business case for these tasks, however it should also review the capability of the business to supply versus the plan.

An Unbiased View of M&a Crm: Best M&a Crm Software

In a current transaction in the chemicals sector, the procurement target was a couple of months right into a multiyear ERP upgrade, with the substantial bulk of the financial investment still to find. Had the correct due persistance not been done, the acquirer would certainly have been confronted Get More Information with a large, unexpected hit to its financials.

Assimilation leaders ought to work closely with modern technology experts as well as company or functional leaders to identify where technology is required to meet the offer rationale and also to quickly chart a course to integration. The assimilation guidebook will be a clean-sheet plan, aligned with all key stakeholders, covering the end-state solution, tasks, resourcing, and investments called for to deliver the innovation section of the integration.

Report this wiki page